Who Pays Sales Tax On Used Car In Florida . The state levies a 6% tax rate on car sales, which the dealer adds upon the completion of a sale. Vehicles purchases are some of the largest sales commonly made in florida, which means that they can lead to a hefty sales tax bill. The florida sales tax rate is 6%. According to autolist.com, buyers are required. Florida’s sales tax for cars is 6%. Here’s how to calculate the florida sales tax on the purchase of a new or used vehicle. Florida collects a six percent sales tax on the purchase of all new or used vehicles. When buying a car in florida, you’ll pay 6% of the vehicle’s purchase price, whether you buy from a private seller or car dealers. Note that sales tax may be higher in. Sales tax is added to the price of. What is the sales tax on cars purchased in florida? Each sale, admission, storage, or rental in florida is taxable, unless the transaction is exempt.

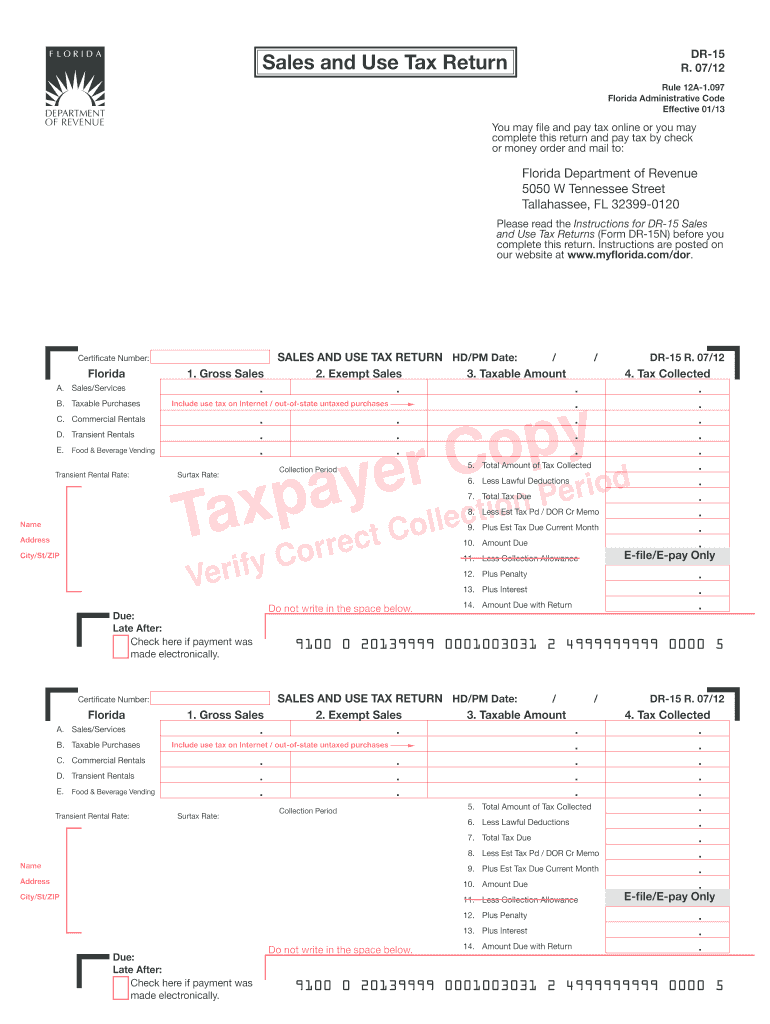

from www.signnow.com

Vehicles purchases are some of the largest sales commonly made in florida, which means that they can lead to a hefty sales tax bill. Here’s how to calculate the florida sales tax on the purchase of a new or used vehicle. What is the sales tax on cars purchased in florida? According to autolist.com, buyers are required. Each sale, admission, storage, or rental in florida is taxable, unless the transaction is exempt. When buying a car in florida, you’ll pay 6% of the vehicle’s purchase price, whether you buy from a private seller or car dealers. Florida’s sales tax for cars is 6%. Note that sales tax may be higher in. The florida sales tax rate is 6%. Florida collects a six percent sales tax on the purchase of all new or used vehicles.

Florida Sales Tax Complete with ease airSlate SignNow

Who Pays Sales Tax On Used Car In Florida Florida’s sales tax for cars is 6%. When buying a car in florida, you’ll pay 6% of the vehicle’s purchase price, whether you buy from a private seller or car dealers. According to autolist.com, buyers are required. Florida’s sales tax for cars is 6%. Florida collects a six percent sales tax on the purchase of all new or used vehicles. Sales tax is added to the price of. Note that sales tax may be higher in. Vehicles purchases are some of the largest sales commonly made in florida, which means that they can lead to a hefty sales tax bill. The florida sales tax rate is 6%. Here’s how to calculate the florida sales tax on the purchase of a new or used vehicle. What is the sales tax on cars purchased in florida? The state levies a 6% tax rate on car sales, which the dealer adds upon the completion of a sale. Each sale, admission, storage, or rental in florida is taxable, unless the transaction is exempt.

From www.uslegalforms.com

Certified Bill Of Sale For A Vehicle Brevard County Tax Collector Who Pays Sales Tax On Used Car In Florida Each sale, admission, storage, or rental in florida is taxable, unless the transaction is exempt. The state levies a 6% tax rate on car sales, which the dealer adds upon the completion of a sale. What is the sales tax on cars purchased in florida? Here’s how to calculate the florida sales tax on the purchase of a new or. Who Pays Sales Tax On Used Car In Florida.

From www.fbasalestax.com

US Sales Tax Rate Map The FBA Sales Tax Guide Who Pays Sales Tax On Used Car In Florida Florida collects a six percent sales tax on the purchase of all new or used vehicles. According to autolist.com, buyers are required. The state levies a 6% tax rate on car sales, which the dealer adds upon the completion of a sale. What is the sales tax on cars purchased in florida? Here’s how to calculate the florida sales tax. Who Pays Sales Tax On Used Car In Florida.

From www.weoffermore.com

What To Watch for When Buying a Used Vehicle in Florida? Sell Your Who Pays Sales Tax On Used Car In Florida When buying a car in florida, you’ll pay 6% of the vehicle’s purchase price, whether you buy from a private seller or car dealers. According to autolist.com, buyers are required. What is the sales tax on cars purchased in florida? Vehicles purchases are some of the largest sales commonly made in florida, which means that they can lead to a. Who Pays Sales Tax On Used Car In Florida.

From www.signnow.com

Su 87 65 20202024 Form Fill Out and Sign Printable PDF Template Who Pays Sales Tax On Used Car In Florida Florida’s sales tax for cars is 6%. According to autolist.com, buyers are required. What is the sales tax on cars purchased in florida? The state levies a 6% tax rate on car sales, which the dealer adds upon the completion of a sale. Here’s how to calculate the florida sales tax on the purchase of a new or used vehicle.. Who Pays Sales Tax On Used Car In Florida.

From www.template.net

Florida Vehicle Bill of Sale Template Google Docs, Word, PDF Who Pays Sales Tax On Used Car In Florida What is the sales tax on cars purchased in florida? Here’s how to calculate the florida sales tax on the purchase of a new or used vehicle. The florida sales tax rate is 6%. Florida collects a six percent sales tax on the purchase of all new or used vehicles. Note that sales tax may be higher in. Each sale,. Who Pays Sales Tax On Used Car In Florida.

From www.patriotsoftware.com

Sales Tax vs. Use Tax How They Work, Who Pays, & More Who Pays Sales Tax On Used Car In Florida According to autolist.com, buyers are required. Note that sales tax may be higher in. Sales tax is added to the price of. Florida collects a six percent sales tax on the purchase of all new or used vehicles. Vehicles purchases are some of the largest sales commonly made in florida, which means that they can lead to a hefty sales. Who Pays Sales Tax On Used Car In Florida.

From www.signnow.com

Florida Sales Tax Complete with ease airSlate SignNow Who Pays Sales Tax On Used Car In Florida What is the sales tax on cars purchased in florida? The state levies a 6% tax rate on car sales, which the dealer adds upon the completion of a sale. Each sale, admission, storage, or rental in florida is taxable, unless the transaction is exempt. Florida’s sales tax for cars is 6%. Sales tax is added to the price of.. Who Pays Sales Tax On Used Car In Florida.

From www.efilesalestax.com

Sales Tax Filing Software for California, Colorado, Florida, and Illinois Who Pays Sales Tax On Used Car In Florida The state levies a 6% tax rate on car sales, which the dealer adds upon the completion of a sale. What is the sales tax on cars purchased in florida? Sales tax is added to the price of. Vehicles purchases are some of the largest sales commonly made in florida, which means that they can lead to a hefty sales. Who Pays Sales Tax On Used Car In Florida.

From autoapprove.com

Sales Tax When Buying A Used Car Your Ultimate Guide Who Pays Sales Tax On Used Car In Florida When buying a car in florida, you’ll pay 6% of the vehicle’s purchase price, whether you buy from a private seller or car dealers. The florida sales tax rate is 6%. What is the sales tax on cars purchased in florida? Vehicles purchases are some of the largest sales commonly made in florida, which means that they can lead to. Who Pays Sales Tax On Used Car In Florida.

From www.carsalerental.com

Bill Of Sale Car Florida Template Car Sale and Rentals Who Pays Sales Tax On Used Car In Florida Vehicles purchases are some of the largest sales commonly made in florida, which means that they can lead to a hefty sales tax bill. When buying a car in florida, you’ll pay 6% of the vehicle’s purchase price, whether you buy from a private seller or car dealers. Here’s how to calculate the florida sales tax on the purchase of. Who Pays Sales Tax On Used Car In Florida.

From privateauto.com

How Much are Used Car Sales Taxes in Indiana? Who Pays Sales Tax On Used Car In Florida Here’s how to calculate the florida sales tax on the purchase of a new or used vehicle. Sales tax is added to the price of. According to autolist.com, buyers are required. Florida’s sales tax for cars is 6%. What is the sales tax on cars purchased in florida? Each sale, admission, storage, or rental in florida is taxable, unless the. Who Pays Sales Tax On Used Car In Florida.

From statesalestaxtobitomo.blogspot.com

State Sales Tax State Sales Tax Exemption Florida Who Pays Sales Tax On Used Car In Florida The florida sales tax rate is 6%. Sales tax is added to the price of. Note that sales tax may be higher in. Each sale, admission, storage, or rental in florida is taxable, unless the transaction is exempt. When buying a car in florida, you’ll pay 6% of the vehicle’s purchase price, whether you buy from a private seller or. Who Pays Sales Tax On Used Car In Florida.

From hettiebanestassia.pages.dev

TaxFree Florida 2024 Lilly Miquela Who Pays Sales Tax On Used Car In Florida Florida’s sales tax for cars is 6%. Florida collects a six percent sales tax on the purchase of all new or used vehicles. Vehicles purchases are some of the largest sales commonly made in florida, which means that they can lead to a hefty sales tax bill. What is the sales tax on cars purchased in florida? According to autolist.com,. Who Pays Sales Tax On Used Car In Florida.

From eforms.com

Free Florida Bill of Sale Forms (3) PDF eForms Who Pays Sales Tax On Used Car In Florida Florida’s sales tax for cars is 6%. When buying a car in florida, you’ll pay 6% of the vehicle’s purchase price, whether you buy from a private seller or car dealers. The state levies a 6% tax rate on car sales, which the dealer adds upon the completion of a sale. The florida sales tax rate is 6%. Florida collects. Who Pays Sales Tax On Used Car In Florida.

From www.educba.com

Sales Tax Types and Objectives of Sales Tax with Examples Who Pays Sales Tax On Used Car In Florida The state levies a 6% tax rate on car sales, which the dealer adds upon the completion of a sale. When buying a car in florida, you’ll pay 6% of the vehicle’s purchase price, whether you buy from a private seller or car dealers. Sales tax is added to the price of. The florida sales tax rate is 6%. What. Who Pays Sales Tax On Used Car In Florida.

From www.carsalerental.com

Illinois Auto Sales Tax Used Car Car Sale and Rentals Who Pays Sales Tax On Used Car In Florida Vehicles purchases are some of the largest sales commonly made in florida, which means that they can lead to a hefty sales tax bill. According to autolist.com, buyers are required. What is the sales tax on cars purchased in florida? Sales tax is added to the price of. Florida’s sales tax for cars is 6%. The florida sales tax rate. Who Pays Sales Tax On Used Car In Florida.

From www.reddit.com

U.S. Sales Tax by State [1484x1419] MapPorn Who Pays Sales Tax On Used Car In Florida Sales tax is added to the price of. Here’s how to calculate the florida sales tax on the purchase of a new or used vehicle. Florida collects a six percent sales tax on the purchase of all new or used vehicles. When buying a car in florida, you’ll pay 6% of the vehicle’s purchase price, whether you buy from a. Who Pays Sales Tax On Used Car In Florida.

From www.ramseysolutions.com

Florida Sales and Use Taxes What You Need to Know Ramsey Who Pays Sales Tax On Used Car In Florida Florida collects a six percent sales tax on the purchase of all new or used vehicles. Here’s how to calculate the florida sales tax on the purchase of a new or used vehicle. The state levies a 6% tax rate on car sales, which the dealer adds upon the completion of a sale. Florida’s sales tax for cars is 6%.. Who Pays Sales Tax On Used Car In Florida.